Why Start Investing Now?

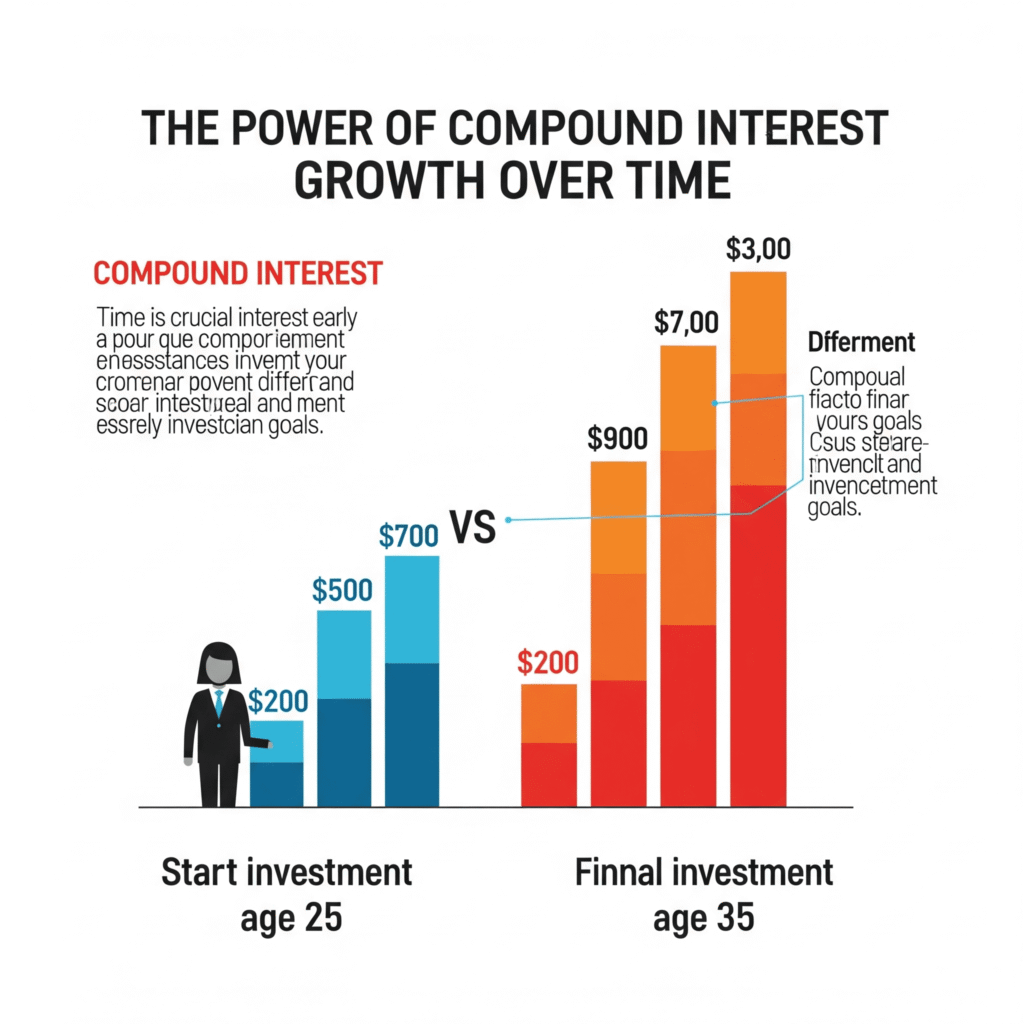

If you’re ready to start investing in stocks, now is the perfect time. The stock market has historically provided better returns than traditional savings accounts, with the S&P 500 averaging 10% annual returns over the past 90 years. Starting early gives you the powerful advantage of compound interest, turning small investments into substantial wealth over time.

Essential Steps Before You Invest

1. Build Your Financial Foundation

Before you begin investing, build an emergency fund that covers 3–6 months of expenses and eliminate any high-interest debt. Only invest money you won’t need for at least five years.

2. Define Your Investment Goals

Determine whether you’re investing for retirement, a house down payment, or long-term wealth building. Your investment timeline influences both your risk tolerance and strategy.

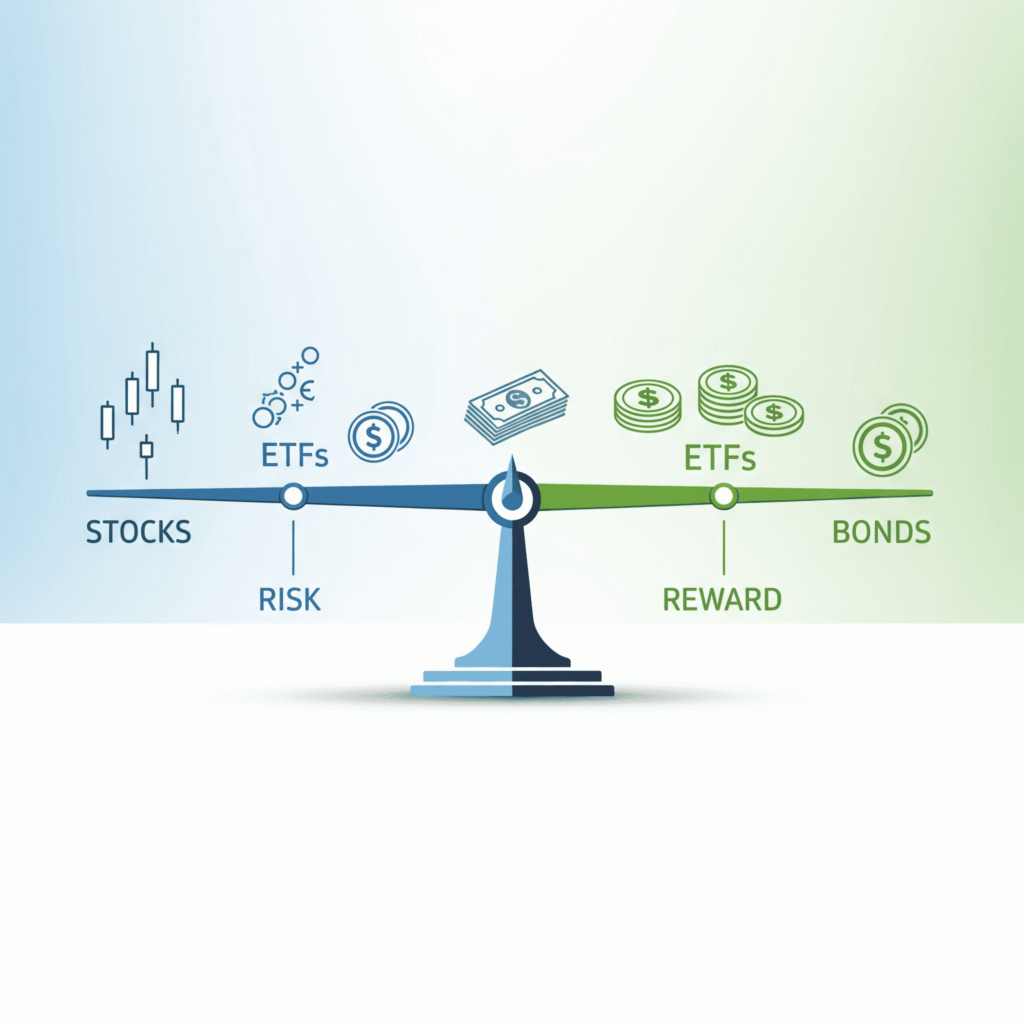

3. Understand Risk vs. Return

Higher potential returns come with higher risk. Diversification across different stocks and sectors helps manage this risk while maintaining growth potential.

Getting Started: Your First Steps

1. Choose a Brokerage Account

Select a reputable broker offering commission-free trades and user-friendly platforms. Popular options include Fidelity, Charles Schwab, and E*TRADE for traditional brokers, or Robinhood and Webull for mobile-first experiences.

Want to dive deeper into stock investing basics? This Investopedia guide offers a practical breakdown of how to start investing with as little as $1,000.

2. Start with Index Funds

Begin with broad market index funds, such as those tracking the S&P 500. These funds automatically diversify your investment across hundreds of companies, reducing risk while providing market returns.

When you start investing in stocks, index funds are a great first step. They offer built-in diversification and steady long-term returns.

New to buying stocks? NerdWallet’s beginner guide is a great resource to understand stock buying, account types, and strategy fundamentals.

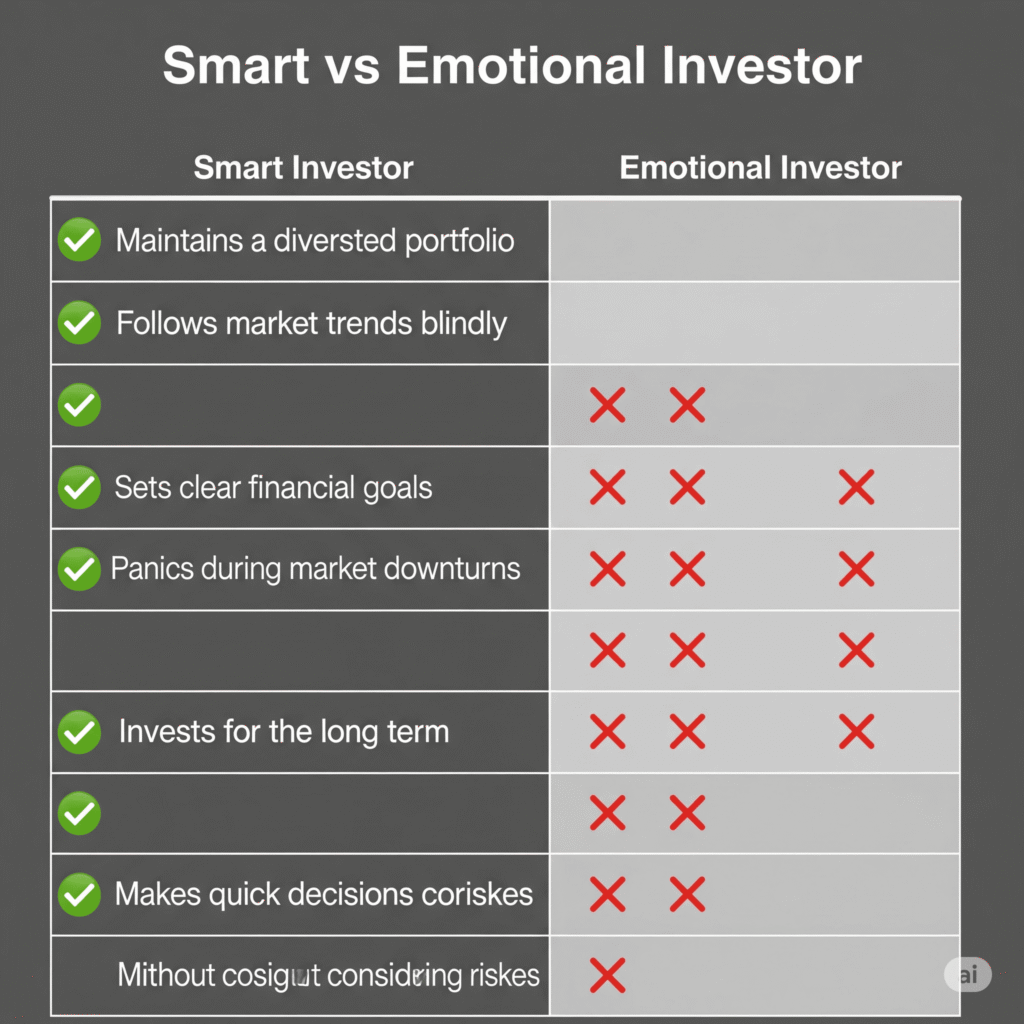

3. Consider Dollar-Cost Averaging

Invest a consistent amount each month or quarter, no matter how the market is performing. This strategy reduces the impact of market volatility and removes emotion from investing decisions.

Smart Investment Strategies for Beginners

1. The 80/20 Rule

Start with 80% index funds for stability and 20% individual stocks for learning and potential higher returns. This balance provides education while managing risk.

2. Research Before Buying Individual Stocks

Study company financials, read annual reports, and understand the business model. Focus on companies with strong fundamentals and growth prospects in industries you understand.

3. Avoid Common Mistakes

Don’t try to time the market, chase hot stocks, or invest money you can’t afford to lose. Letting emotions guide your investing can cause you to buy at peaks and sell during dips.

If you’re ready to start investing in stocks, these beginner-friendly strategies will help you build confidence while minimizing risk.

Managing Your Investment Portfolio

1. Monitor but Don’t Obsess

Check your portfolio monthly, not daily. Market fluctuations are normal, and frequent checking can lead to panic selling during temporary downturns.

2. Rebalance Annually

Review and adjust your portfolio yearly to maintain your desired asset allocation. Rebalance by selling assets that have grown significantly and buying those that are lagging.

3. Keep Learning

Read financial news, investment books, and consider online courses. A better understanding leads to smarter investment choices.

Staying consistent is key when you start investing in stocks — avoid emotional decisions and stick to your strategy.

Key Takeaways

Stock market investing isn’t gambling when done thoughtfully. Start small, stay consistent, and focus on long-term growth rather than quick profits. The investment choices you make today shape your financial future.

Anyone can start investing in stocks with the right mindset and tools, even on a small budget.

Call-to-Action: Ready to start your investment journey? What’s stopping you from getting started? Share your investing questions in the comments below!

If you liked this blog, Please checkout our other blogs Best Cybersecurity Tips for Complete Online Protection and How to Stay Updated with Global News Without Getting Overwhelmed

Pingback: How to Stay Updated with Global News Without Getting Overwhelmed - Daily Oops